is there a death tax in texas

2000000 in 2006 - 2008. The rates range anywhere from 10 20.

10 Death Tax Myths Howstuffworks

Estate taxes and inheritance taxes.

:watermark(cdn.texastribune.org/media/watermarks/2016.png,-0,30,0)/static.texastribune.org/media/images/2016/01/28/marijuana_stamps.jpg)

. There are two main types of death taxes in the united states. There is no Federal inheritance tax. The federal estate tax is a tax on your right to transfer property at your.

This tax is levied on each individual heir based on the value of the assets that they inherited. A person who died in 2016 will only have estate taxes if the estate is worth more than 549 million. First the heirs owes tax either motor vehicle use tax.

Armed services killed or fatally injured in the line of duty to a total property tax exemption on his or her. Once again Texas has no inheritance tax. Texas does not have a state-level estate tax but some other states do.

Tax Code Section 11133 entitles a surviving spouse of a member of the US. The estate tax sometimes known as the death. The federal estate tax disappears in 2010.

The 2021 federal estate tax exemption has been large for 2021 the exemption is 117 million. There is a 40 percent federal tax however on estates over 534. Death Taxes in Texas Inheritance and estate taxes are often grouped under the label death taxes Texas repealed its inheritance tax on September 15 2015.

What Is the Estate Tax. After you calculate the taxable portion of the estate the applicable tax rates ranging from 18 to 40 are applied to the estate tax bracket the amount falls into. In addition to taxes due at the federal and state level there is also another tax known as an inheritance tax.

That amount is per person. Texas Inheritance Tax and Gift Tax. Many states require an estate tax in.

Although Texas used to have an inheritance tax it was abolished on September 1 2015. Taxes levied at death based on the value of property left behind. Federal exemption for deaths on or after January 1 2023.

However there is still a federal estate tax that applies to all property that exceeds the 1206 exemption bar if a person has deceased after. When a motor vehicle is transferred by the heirs of a deceased person to another person two taxable transactions have taken place. While there is no state inheritance tax in Texas your estate may be subject to the federal estate tax.

That 1118 million is a per person amount calculated on everything you own or have a certain interest in at the time of that persons death. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Like the inheritance tax there is no estate tax in Texas.

There is also no inheritance tax in Texas. Taxes levied at death based on the value of property left behind. 3500000 for decedents dying in 2009.

Estate tax return within 9 months of the death. This means that the Texas Constitution also limits the Texas Legislature from imposing an inheritance or estate tax on real and. For a married couple the total amount is 234.

Federal estate taxes do not apply to. It is one of 38 states that do not have an estate tax. Second there are certain deductions that may be.

A filing is required for estates with combined gross assets and prior taxable gifts exceeding 1500000 in 2004 - 2005. Is There A Death Tax In Texas. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from.

Michael Cohen Dallas Elder Lawyer Assets Attorney Benefits Care Deeds Elder Estate Firm Lady Bird Law Lawyer Living Medicaid Planning Poa Power Of Attorney Probate Protect Protection Social Security Trusts Va

Estate Tax Texas Aglaw Blog Towntalk Radio

Texas Inheritance Laws What You Should Know Smartasset

The Death Tax Isn T So Scary For States Tax Policy Center

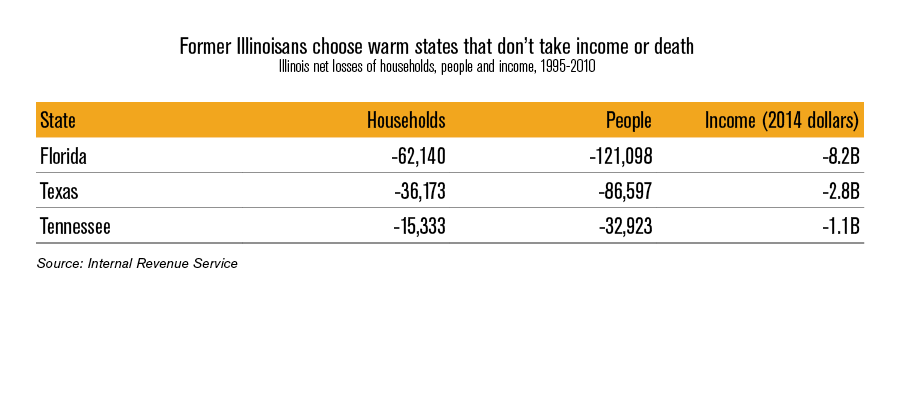

Illinois Should Repeal The Death Tax

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

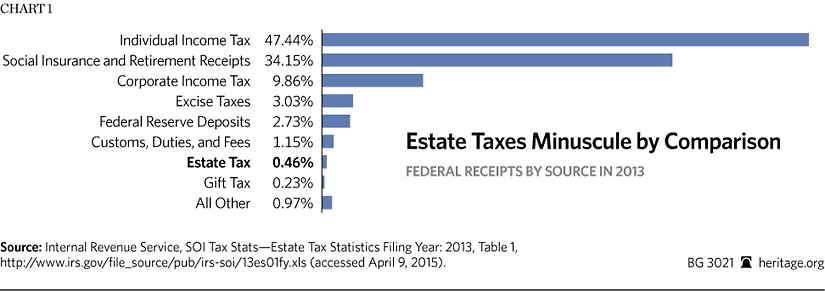

State Death Tax Is A Killer The Heritage Foundation

Talking Taxes Estate Tax Texas Agriculture Law

Death Tax In Texas Estate Inheritance Tax Law In Tx

Death Tax In Texas Estate Inheritance Tax Law In Tx

Taxes For Beneficiaries And Heirs In Texas Silberman Law Firm Pllc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2022 Property Taxes By State Report Propertyshark

/cdn.vox-cdn.com/uploads/chorus_asset/file/22363424/210308_fciccolella_voxmedia_inheritance_secondaryillustration.jpg)

How Inheritance Became A Gift A Necessity And A Curse Vox

/cloudfront-us-east-1.images.arcpublishing.com/dmn/XON2HRNKLFDBLM6ZDNGOYDTUVQ.png)

Death And Taxes The Imperiled Federal Estate Tax Exemption

Is There An Inheritance Tax In Texas

A Guide To Estate Taxes Mass Gov

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation